Price Elasticity of Demand (|Ed|)

Elasticity is a measure of how much the quantity demanded will be affected by a change in price or income or change in price of related goods. There are three main types of elasticities: price elasticity of demand, income elasticity of demand and cross elasticity of demand.

When the price of a good falls, the quantity demanded of the good will normally rise. Price elasticity of demand measures the responsiveness of a change in quantity demanded for a good or service to a change in its price. Mathematically, the price elasticity of demand is the ratio of the relative (or percentage) change in quantity demanded to the relative (or percentage) change in price.

For example:

Price Elasticity of Demand = "$ \%\Delta QD / \% \Delta P \times P / QD $"

P is the original price and Q the original quantity)

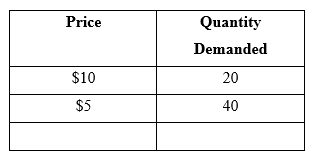

If price of a product falls from $10 to $5, then quantity demanded increases from 20 to 40, then the price elasticity is calculated as

"$ 20 / -\$5 \times \$10/20 = - 4 \times 0.5 = - 2 $"

This means that this product is highly elastic because it is greater than 1. As a result, small changes in prices will lead to large changes in quantity demanded. Since the demand curve is downward sloping, the price elasticity will always have a negative sign. To interpret the calculation, simply use the positive or absolute value obtained. As in the example above -2 must be interpreted as +2. As a general rule therefore, when the price elasticity of demand is greater than one, we say that demand is price elastic and when it is less than one, we say that demand is price inelastic.

Determinants of Price Elasticity of Demand

The following is a summary of the factors that influence the price elasticity of demand.

- Number of substitutes - Substitution Effect: If a product can be easily substituted, its demand is elastic.

- Necessity vs Luxury: Demand for necessities is usually inelastic because there are usually very few substitutes for necessities. On the other hand, luxury products, such as leisure sail boats, are not needed on a daily basis. Therefore, demand for these goods is more elastic.

- The percentage of income spent on the good (Income Effect): The larger the percentage of income spent on a good, the more elastic is its demand. On the other hand, the smaller the percentage of income spent on a good, the less elastic is its demand.

- Time lag: The longer the time after the price change, the more elastic will be the demand. This is so because consumers are given more time to carry out their actions.

Income Elasticity of Demand

Income elasticity is defined as the change in demand when income changes. In most cases, but not all, the increase in income increases demand. To measure this response, we have the income elasticity of demand,

"$ \text{Income Elasticity } = \frac{\text{% Change in Demand}}{\text{% Change in Income}} $"

If the income elasticity is positive, we say that the good is a normal good which means that the demand for such a good rises when income rises. If the income elasticity is negative, we say that the good is an inferior good meaning that as income rises, the demand for this good will fall.

Cross Elasticity of Demand

Sometimes the price of one good may cause a change in demand for another good. A measure of this response is referred to as cross elasticity. For example, an increase in the price of chicken may increase the demand for beef. Cross-elasticity of demand is calculated as:

"$ \text{Cross Elasticity } = \frac{\text{% Change in Demand of one product}}{\text{% Change in Price of the other product}} $"

As an example, suppose the price of chicken goes up by 10 percent and as a result the quantity demanded of beef increases by 4 percent (assuming with no change in the price of beef or anything else that would influence the demand for beef), then the cross-elasticity of demand for beef, with respect to the price of chicken, is 4/10 = 0.4.

If the cross elasticity is positive, it means that an increase in the price of one good will increase the demand for the other good. We say that the two goods are substitutes. If the cross-elasticity of demand is negative, then an increase in the price of one good decreases the demand for the other. In this case, we say that these two goods are complements.

Price Elasticity of Supply

Price elasticity of supply measures the degree of sensitivity of production to a change in price. It is calculated as:

"$ \text{Es} = \% \text{ change in Quantity Supplied Qs} / \% \text{ change in Price} $"

Example:

If the price of Product A increased by 40% and the quantity supplied increases by 20%, then the price elasticity of the supply of Product A is:

"$ \text{Es} = \text{ percentage change in Qs} / \text{ percentage change in Price} = (20) / (40) = 0.5 $"

The price elasticity coefficient will always be positive because there is a positive relationship between price and quantity supplied. When price increases, quantity supplied increases and when price declines, quantity supplied falls.