The Foreign Exchange Market

The foreign exchange market provides the physical and institutional means through which the currency of one country is exchanged for that of another country. The price at which this transaction takes place is known as the exchange rate. A foreign exchange transaction is an agreement between a buyer and a seller that a given amount of one currency is to be delivered at a specified price (rate) for some other currency.

The Exchange Rate

An exchange rate is the rate at which one currency can be exchanged for another currency. In other words, it is the value of a country's currency in terms of another country’s currency. In the same way that there is a price for any other commodity, there is also a price for the currency of other countries which is the exchange rate. For example, if you are travelling to the United States and the exchange rate between the US Dollar and the TT Dollar is US$1.00 = TT$6.30, this means that you will have to pay TT$6.30 for every US Dollar.

Exchange Rate Systems

There are three broad categories of exchange rate systems:

Free or Flexible-Floating Systems

In a free-floating exchange rate system, governments and Central Banks do not participate in the market for foreign exchange since it is left to the market. The demand for and supply of the currency on the foreign exchange market determine the price (exchange rate) for the currency.

Managed Float Systems

Under a managed float, exchange rates are still free to float based on market demand and supply, however, governments may influence their values by limiting the extent of the float so as to prevent sudden large swings in the value of a nation’s currency.

Fixed Exchange Rates

A fixed exchange rate system is an exchange rate system in which governments try to maintain the currency value that is constant against a specific currency. This is also referred to as pegging the exchange rate. In a fixed exchange-rate system, a country's government decides the worth of its currency against those of other countries. To ensure that a currency will maintain its pegged value, the country's central bank maintains reserves of foreign currencies and gold.

Determination of the Exchange Rate

In the floating exchange rate regime, the exchange rate is determined by the forces of demand and supply.

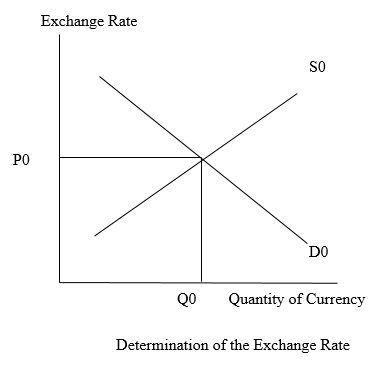

Equilibrium Exchange Rates

The equilibrium exchange rate occurs where demand for the home currency equals supply. The equilibrium exchange rate will be P0 which is where the demand curve D0 equals the supply curve S0 and equilibrium quantity is Q0 as can be seen in the following graph.

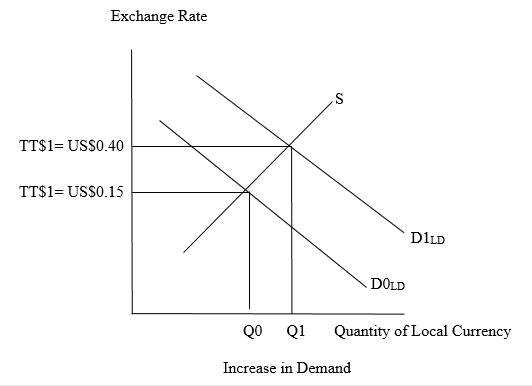

Increase in Demand for the Local Currency

A change in either demand for or supply of the currency will lead to a change in the equilibrium price (exchange rate). For example, if there is an increase in the demand for the local Dollar, the demand curve for the local Dollar will therefore shift to the right from D0 to D1. This results in an increase in quantity supplied of the local Dollar from Q0 to Q1 and the price of the local Dollar will increase from $0.15US= $1LD to $0.40US=$1LD as seen in the following graph. This increase in the price of the local Dollar translates into a rise in the value or an appreciation of the local Dollar. This is the same as saying that US goods will now cost less for the local citizens.

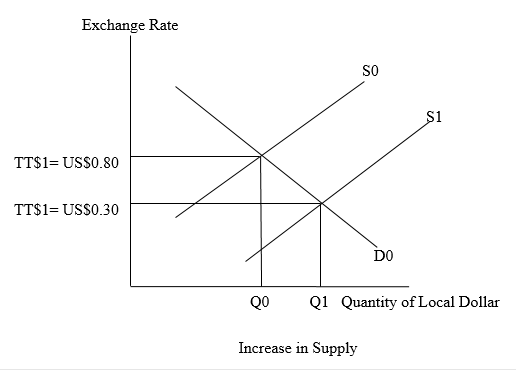

Increases in supply of a currency

An increase in the supply of the local currency to purchase the US Dollar will cause the supply curve for the local Dollar to shift to the right from S0 to S1 as shown in the following graph. The supply of the local currency will increase from Q0 to Q1 and the price will fall from $US0.80 to $US0.30. This means that local citizens will now be getting less US Dollars for the local Dollar than before. The local currency would have depreciated.

Depreciation and Appreciation

A depreciation refers to a fall in the value of a country’s currency on the foreign exchange market. This will result in imports becoming more expensive and exports cheaper. On the other hand, an appreciation refers to a rise in the value of the country’s currency. If there is a currency appreciation, the country’s residents will find imported goods to be cheaper relative to goods produced domestically, and the volume of imports will increase.

Devaluation and Revaluation

Devaluation is the deliberate downward adjustment in the official exchange rate which reduces the currency's value. A devaluation works the same as that of a depreciation where the former is for the case of a fixed exchange rate system while the latter is for the case of a flexible exchange rate system. In contrast, a revaluation is an upward change in the currency's value which increases the value of the country’s currency. With a revaluation, the foreign price of exports will increase and these foreign buyers will find the local exports to be more expensive. This will in turn cause a fall in exports. On the other hand, imports will become cheaper relative to exports and so imports will tend to rise.