International Trade

International trade is the exchange of goods and services across international boundaries or territories. Industrialization, improvement in transportation, globalization, multinational corporations, advancement in technology and outsourcing have all had a major impact on the international trade system. In international trade, countries import or purchase from foreign countries the products which they cannot produce and export or sell products which they can produce.

Theories of Trade

Adam Smith Theory of Absolute Advantage

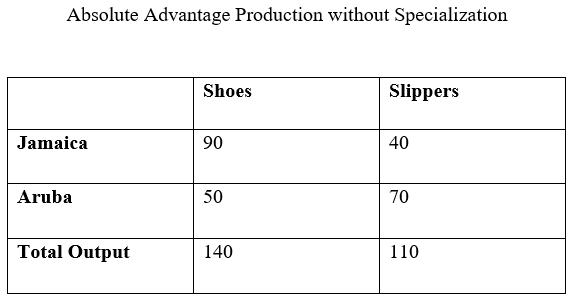

A country has an absolute advantage over another in producing a good, if it can produce that good using fewer resources than another country. For example, if one unit of labour in Jamaica can produce 90 units of shoes or 40 units of slippers, while in Aruba one unit of labour makes 50 units of shoes or 70 units of slippers, then Jamaica has an absolute advantage in producing shoes and Aruba has an absolute advantage in producing slippers. Jamaica can get more slippers with its labor by specializing in shoes and trading the shoes for Aruba’s slippers, while Aruba can benefit by trading slippers for shoes as can be seen in the following table.

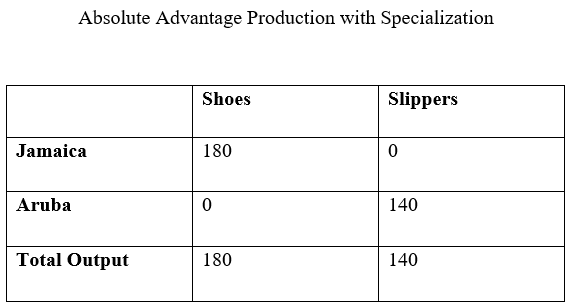

Specializing in the production of that product which each country has an absolute advantage of can result in more output than without specialization. Without specialization and trade, total output in shoes was 140 units while total output of slippers was 110 units. Now if Jamaica specializes in the production of shoes and Aruba specializes in the production of slippers, the production of both shoes and slippers will now increase. With specialization, shoe production will increase from 140 units to 180 units while slipper production will increase from 110 slippers to 140 slippers as seen in the following table.

Ricardian Comparative Advantage Theory of Trade

The principle of comparative advantage shows that even if a country has no absolute advantage in any product, the disadvantaged country can still benefit from specializing in and exporting the product(s) for which it has the lowest opportunity cost of production. In a Ricardian model, countries specialize in producing what they produce best. The Ricardian model does not directly consider factor endowments, such as the relative amounts of labour and capital within a country. The principle of comparative advantage shows that what matters is not the absolute cost, but the opportunity cost of production.

Gains or Benefits from Trade

The following are some of the gains from trade:

Producers – local producers gain from trade when their goods and services are purchased by foreigners. This allows these local producers to increase their incomes even though there is an increase in risk from exporting overseas.

Consumers – consumers may have access to goods and services which they may not have had otherwise.

Innovation – countries that have reduced trade barriers and increased the share of imports and exports in their economies tend to be among the fastest-growing nations and possess more technical innovation.

Foreign Exchange – an economy earns increased amounts of foreign exchange through international trade.

Trade Protection and Promotion Measures

Governments can implement several measures in order to protect and promote trade in their country. Some of these measures are as follows:

Tariffs – are duties (taxes) imposed on imports. When tariffs are imposed, the prices of imports would increase to the extent of the tariff. The increased prices will reduce the demand for imported goods and, at the same time, induce domestic producers to produce more of import substitutes.

Quotas – with a quota system, the government may fix and permit the maximum quantity or value of a commodity to be imported during a given period. By restricting imports through the quota system, the trade deficit is reduced and the balance of payments position is improved. Advantages of quotas are: they are more effective than tariffs as they are certain, easier to implement and more flexible than tariffs.

Export Promotion – the government can adopt export promotion measures to correct disequilibrium in the balance of payments. This includes substitutes, tax concessions to exporters, marketing facilities, credit and incentives to exporters. The government may also help to promote export through exhibition, trade fairs, conducting marketing research and by providing the required administrative and diplomatic assistance to tap into potential markets.

Import Substitution – a country may resort to import substitution to reduce the volume of imports and make it self-reliant. Industries which produce import substitutes require special attention in the form of various concessions, which include tax concession, technical assistance and subsidies.

Arguments in favour of Tariffs

Although some advocates may say that tariffs can result in a welfare loss to society, tariffs are perceived by many as having critical advantages to developing and emerging economies. Some of these advantages are as follows:

Infant-industry protection – by protecting new domestic industries from established foreign competitors, a tariff can give a struggling industry time to become an effective competitor. This is an attempt to protect small local industries.

Job protection argument – supporters, especially unions, say that tariffs should be used to keep foreign labour from taking away local jobs.

To raise revenue for the government – tariffs can also have the added advantage of raising revenues for the government. When a government imposes a tariff in order to reduce imports in an attempt to solve for balance of payments disequilibrium, this is also revenue to the central government.

Lower or prevent balance of payment deficits – tariffs are used in order to assist in reducing imports relative to exports in order to bring equilibrium in the country’s balance of payments.